In the dynamic world of trading, the pursuit of the ideal indicator or combination thereof is a perennial challenge. Traders often find themselves grappling with the age-old question: which indicator holds the key to consistent profits? While some may advocate for a blend of indicators, others remain steadfast in their belief in a single, all-powerful metric. So, what’s the truth behind the quest for the ultimate trading indicator?

Understanding the 4 Indicator Categories

Before diving into the quest for the best indicator, it’s essential to understand the fundamental categories of indicators:

1. Trend Following Indicators

Trend-following indicators serve as indispensable tools in the arsenal of traders, offering valuable insights into prevailing market trends. By analysing price data over time, these indicators help traders identify the direction of market movements and make informed trading decisions.

Pros:

- Clear Trend Identification: Trend-following indicators provide clear signals for identifying the direction of prevailing market trends, enabling traders to align their strategies with the dominant market sentiment.

- Smoothed Price Data: By smoothing out price fluctuations, these indicators offer a clearer depiction of long-term market trends, allowing traders to filter out noise and focus on significant price movements.

- Simple Interpretation: Trend-following indicators are relatively straightforward to interpret, making them accessible to traders of all experience levels. Their intuitive nature facilitates quick decision-making and enhances trading efficiency.

Cons:

- Lagging Signals: One of the primary drawbacks of trend-following indicators is their inherent lagging nature, as they generate signals after the trend has already been established. This lag may result in missed opportunities or delayed entries and exits for traders.

- Whipsawing in Choppy Markets: In choppy or sideways markets, trend-following indicators may produce false signals, leading to whipsawing and potential losses for traders. These indicators struggle to adapt to non-trending market conditions, posing challenges for traders during periods of low volatility.

- Limited Effectiveness in Range-bound Markets: Trend-following indicators are less effective in range-bound markets where prices oscillate within a confined range. Traders may encounter difficulties in distinguishing between genuine trend reversals and temporary price fluctuations, compromising the accuracy of their trading signals.

Uses:

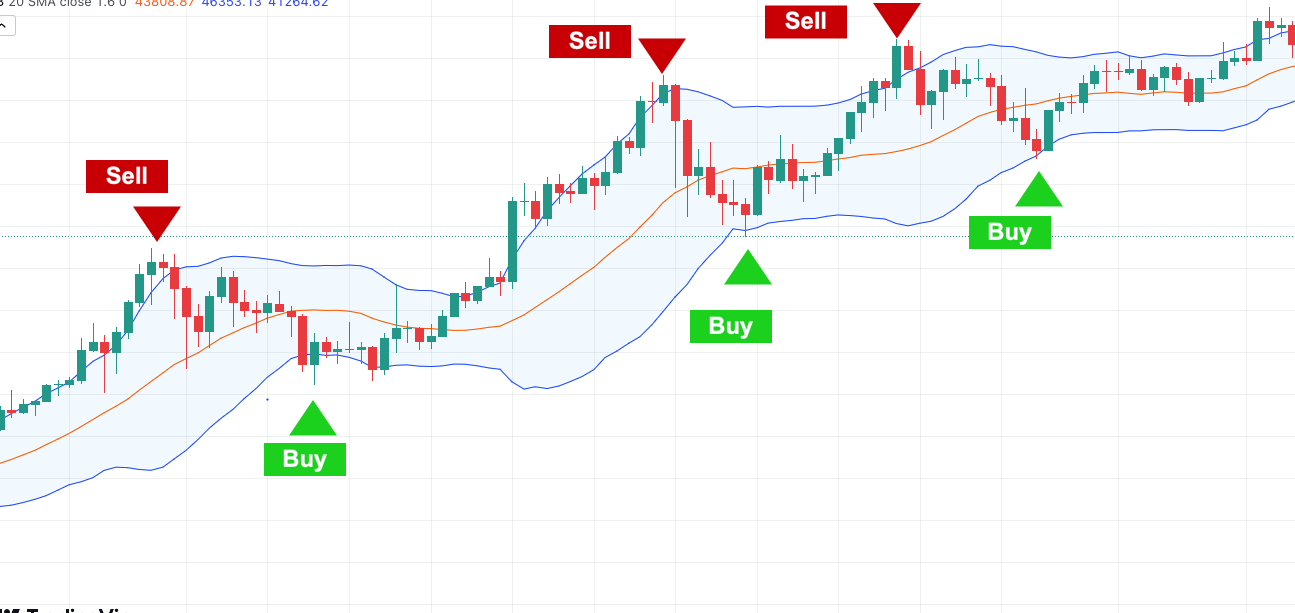

- Confirming Trends: Trend-following indicators play a pivotal role in confirming the existence and strength of prevailing market trends. By identifying upward, downward, or sideways movements in asset prices, these indicators empower traders to align their positions with the dominant market direction.

- Identifying Entry and Exit Points: These indicators assist traders in identifying optimal entry and exit points based on the direction of the prevailing trend. By generating buy or sell signals in response to trend reversals or continuations, trend-following indicators facilitate timely decision-making and enhance trading precision.

- Establishing Trend Bias: Trend-following indicators enable traders to establish a bias towards buying (in uptrends) or selling (in downtrends) based on the direction of the prevailing trend. By gauging the strength and momentum of market trends, these indicators provide valuable insights into potential market reversals or extensions.

Examples: Simple Moving Average (sma), Exponential Moving Average (ema), Hull Moving Average (hma), Moving Average Convergence Divergence (macd), Super Trend Indicator (supertrend)

2. Momentum Indicators

Momentum indicators constitute a vital category of technical analysis tools, providing traders with valuable insights into the speed and strength of price movements. By measuring the rate of change in asset prices, these indicators empower traders to identify potential trend reversals, confirm existing trends, and pinpoint overbought or oversold conditions.

Pros:

- Price Momentum Assessment: Momentum indicators offer a comprehensive assessment of price momentum, enabling traders to gauge the strength and velocity of market trends. By quantifying the rate of price change, these indicators provide valuable insights into the underlying dynamics driving market movements.

- Trend Confirmation: These indicators serve as effective tools for confirming the validity of existing market trends. By detecting changes in price momentum, momentum indicators help traders distinguish between genuine trend reversals and temporary price fluctuations, enhancing the accuracy of their trading signals.

- Overbought/Oversold Identification: Momentum indicators facilitate the identification of overbought or oversold conditions in the market, signaling potential reversal points for traders. By highlighting extreme price levels relative to historical price action, these indicators assist traders in timing their entries and exits more effectively.

Cons:

- Lagging Nature: Similar to trend-following indicators, momentum indicators exhibit a lagging nature, as they generate signals after the occurrence of price movements. This inherent lag may result in delayed responses to market changes, potentially impacting the timeliness of trading decisions.

- Whipsawing in Choppy Markets: In choppy or range-bound markets, momentum indicators may produce false signals, leading to whipsawing and erratic trading outcomes. Traders must exercise caution when relying on momentum indicators in non-trending market conditions to avoid false signals and misinterpretations.

- Dependence on Price Data: Momentum indicators heavily rely on price data for their calculations, which can pose challenges in volatile market conditions or during periods of irregular price movements. Sudden price spikes or erratic fluctuations may distort the accuracy of momentum readings, affecting the reliability of trading signals.

Uses:

- Trend Confirmation and Reversal: Momentum indicators play a crucial role in confirming the strength and direction of prevailing market trends. By analysing changes in price momentum, these indicators provide traders with valuable insights into potential trend reversals or continuations, guiding them in making informed trading decisions.

- Overbought/Oversold Conditions: These indicators help traders identify overbought or oversold conditions in the market, indicating potential exhaustion points for price movements. By monitoring momentum levels relative to historical norms, traders can anticipate market reversals and adjust their trading strategies accordingly.

- Divergence Analysis: Momentum indicators facilitate divergence analysis, allowing traders to compare price movements with momentum readings for potential trend reversals or continuations. Divergence between price and momentum indicators can serve as a powerful signal for identifying shifts in market sentiment and potential trading opportunities.

Examples: Relative Strength Index (rsi), Stochastic Oscillator (stoch), Average Directional Index (adx)

3. Volatility Indicators

Volatility indicators constitute a crucial category of technical analysis tools, providing traders with insights into the degree of price dispersion or variability in the market. By quantifying market uncertainty and price fluctuations, these indicators enable traders to assess risk levels, identify potential breakout or reversal opportunities, and set appropriate stop-loss levels.

Pros:

- Risk Assessment: Volatility indicators offer a reliable means of assessing market risk by measuring the degree of price variability or dispersion around a certain point. By quantifying market uncertainty, these indicators assist traders in evaluating the potential magnitude of price movements and adjusting their risk management strategies accordingly.

- Breakout Identification: Volatility indicators serve as effective tools for identifying potential breakout opportunities in the market. By monitoring changes in volatility levels, traders can anticipate periods of increased price movement and position themselves to capitalise on emerging trends or market shifts.

- Stop-loss Placement: These indicators help traders set appropriate stop-loss levels by taking into account current volatility conditions. By adjusting stop-loss orders based on volatility levels, traders can mitigate the risk of adverse price movements and protect their capital more effectively.

Cons:

- False Signals in Low Volatility: In low volatility environments, volatility indicators may generate false signals or fail to provide meaningful insights into market conditions. Traders must exercise caution when relying on volatility indicators in such scenarios to avoid erroneous trading decisions or misinterpretations.

- Delayed Responses to Changes: Similar to other technical indicators, volatility indicators may exhibit a lagging nature, as they generate signals after the occurrence of price movements. This inherent lag may result in delayed responses to changes in market volatility, potentially impacting the timeliness of trading decisions.

- Sensitivity to Market Conditions: Volatility indicators are highly sensitive to market conditions and may produce erratic readings during periods of extreme volatility or irregular price movements. Traders must consider the prevailing market environment and exercise prudence when interpreting volatility signals to avoid false signals or misjudgments.

Uses:

- Breakout Trading: Volatility indicators play a crucial role in breakout trading strategies by helping traders identify periods of increased price movement or volatility expansion. By monitoring volatility levels, traders can anticipate potential breakout opportunities and enter trades in the direction of the prevailing trend, aiming to capture significant price movements.

- Stop-loss Placement: These indicators assist traders in setting appropriate stop-loss levels by taking into account current volatility conditions. By adjusting stop-loss orders based on volatility levels, traders can ensure that their positions are adequately protected against adverse price movements while allowing for sufficient room for market fluctuations.

- Trend Confirmation: Volatility indicators can confirm the strength and sustainability of existing market trends by assessing volatility levels relative to historical norms. Increasing volatility may signal the continuation of an ongoing trend, while decreasing volatility may indicate potential trend reversals or consolidation phases.

Examples: Bollinger Bands (bbands), Average True Range (ATR), or a Standard Deviation (stdddev)

4. Volume Indicators

Volume indicators form an essential component of technical analysis, providing traders with insights into the strength and sustainability of price movements based on trading volume. By quantifying the level of market participation and investor sentiment, these indicators offer valuable signals for confirming trends, detecting potential reversals, and assessing the overall health of the market.

Pros:

- Confirmation of Price Trends: Volume indicators serve as reliable tools for confirming the validity and strength of price trends by analysing trading volume alongside price movements. Increasing volume accompanying price advances or declines suggests strong market conviction, reinforcing the significance of the prevailing trend.

- Detection of Trend Reversals: These indicators can help traders detect potential trend reversals by identifying divergences between price and volume. Divergent movements, where prices move in one direction while volume trends in the opposite direction, may signal impending reversals or shifts in market sentiment.

- Insight into Market Participation: Volume indicators offer insights into market participation and investor sentiment, allowing traders to gauge the level of interest or commitment among market participants. High volume levels during price advances indicate bullish enthusiasm, while low volume during rallies may suggest weakening conviction.

Cons:

- Limited Application in Low-Volume Markets: Volume indicators may exhibit limited effectiveness in low-volume markets or thinly traded instruments, where fluctuations in trading volume may not accurately reflect underlying market dynamics. Traders must exercise caution when relying solely on volume-based signals in such environments to avoid false interpretations or misjudgments.

- Delayed Responses to Price Movements: Similar to other technical indicators, volume indicators may experience delays in responding to changes in price movements, as they generate signals based on historical volume data. This lagging nature may result in delayed confirmation of price trends or reversals, impacting the timeliness of trading decisions.

- Sensitivity to Market Conditions: Volume indicators are sensitive to market conditions and may produce erratic readings during periods of extreme volatility or irregular price movements. Traders should consider the prevailing market environment and exercise prudence when interpreting volume signals to avoid false signals or misinterpretations.

Uses:

- Confirmation of Price Trends: Volume indicators play a vital role in confirming the strength and sustainability of price trends by analysing trading volume alongside price movements. Increasing volume accompanying price advances or declines provides confirmation of the prevailing trend direction, reinforcing traders’ confidence in their trading decisions.

- Detection of Accumulation and Distribution: These indicators help traders identify accumulation and distribution patterns by analysing changes in trading volume relative to price movements. Increasing volume during price advances suggests accumulation by buyers, while decreasing volume during rallies may indicate distribution by sellers.

- Confirmation of Breakouts and Reversals: Volume indicators assist traders in confirming breakout signals and trend reversals by analysing volume trends alongside price movements. High volume accompanying breakout signals validates the strength of the price move, while divergences between price and volume may signal potential reversals or shifts in market sentiment.

Examples: On Balance Volume (obv), Accumulation Distribution Line (ad), Ease of Movement (emv)

Mastering the Indicator Mix

Navigating the vast array of trading indicators can often feel like traversing through a labyrinth, with each indicator offering its unique insights into market dynamics. However, the true challenge lies not in selecting a multitude of indicators but in combining them effectively to extract actionable intelligence. Instead of succumbing to the allure of stacking indicators indiscriminately, traders must adopt a discerning approach, focusing on synergy and coherence in their indicator selection.

Strategic Integration of Indicators

The key to successful indicator integration lies in understanding the distinctive roles and characteristics of each indicator category and selecting complementary indicators that provide corroborating, rather than conflicting, signals. Rather than aiming for quantity, traders should prioritise quality, opting for a streamlined set of indicators that offer diverse perspectives while minimising redundancy.

Harmonising Indicator Signals

Achieving harmony among indicator signals involves identifying correlations and divergences among indicators and discerning the underlying market dynamics driving these signals. Traders should seek convergence among indicators, where multiple indicators align to reinforce a particular market bias, offering heightened confidence in trading decisions. Conversely, conflicting signals warrant caution and may indicate underlying market ambiguity or indecision.

Maximising Informational Synergy

The ultimate objective of combining indicators is to leverage their collective insights to gain a comprehensive understanding of market conditions and trends. By selecting indicators that complement each other’s strengths and weaknesses, traders can construct a robust analytical framework that offers nuanced insights into price dynamics, trend strength, and potential reversals. The synergy between indicators enhances the reliability of trading signals, empowering traders to make informed decisions with greater conviction.

Striking a Balance

While the temptation to overload charts with an abundance of indicators may be strong, traders must exercise restraint and prioritise clarity and simplicity in their analysis. A cluttered chart inundated with conflicting signals can obscure meaningful patterns and impede decision-making, leading to confusion and suboptimal outcomes. Instead, traders should strike a balance between comprehensiveness and clarity, focusing on quality over quantity in their indicator selection.

Conclusion

In the labyrinthine world of trading indicators, success lies not in the accumulation of indicators but in the strategic integration of complementary signals. By navigating the indicator maze with discernment and foresight, traders can harness the collective power of diverse indicators to gain deeper insights into market dynamics and elevate their trading proficiency. Through thoughtful selection, harmonisation, and synergistic integration of indicators, traders can chart a clearer path to trading success amidst the complexity of financial markets.

Did you enjoy this?

Read some of our other articles on other indicators:

Unveiling the Mystery Behind Simple vs Exponential vs Hull Moving Average

Master Relative Strength Index (RSI) to Unlock Profits Trading

The Power of Moving Average Convergence Divergence (MACD) in Trading

On Balance Volume (OBV): The Most Underutilised Indicator in Trading

What is the Super Trend Indicator? How can you make profit with it?

Leave a Reply