Action Blocks #

Experience seamless automation with Action Blocks, the driving force behind executing buy and sell orders. These blocks act as triggers, responding to conditions established by Data Watchers, Indicator Blocks, and Maths Blocks.

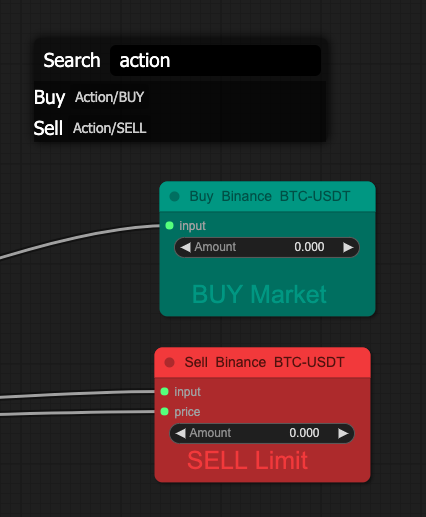

To create a new Action block, double click in the blueprint screen, or click the + button in the menu. In the search bar, search either action, buy or sell.

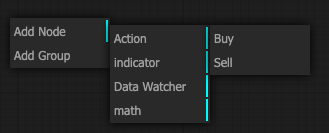

Alternatively, Right Click and click Add Node > Action

Buy and Sell Blocks Parameters: #

Within each block, users specify essential parameters. To change the parameters, double click on the block.

- Exchange:

– Choose the exchange that matches the Action block will trigger a signal to (e.g. Coinbase). Note: This should be the same exchange account that your Scenario is linked to in your Scenario settings. Also, the same exchange that the Data Watcher blocks are monitoring market data for.

- Asset Pair:

- Define the trading pair, such as BTC/USD, to focus on specific assets in your strategy.

- Order Type:

- Decide between a Limit Order for controlled pricing or a Market Order for immediate execution.

- Order Amount:

- Set whether the order involves a fixed amount or a percentage of the total asset value in your account. Note: The value input for the order amount should be specified in a Math Block as an input to this block.

- Amount As:

- This defines whether the value being input is as a fixed amount, or a percentage of the value of your account. For example, if your amount is 50 and the trading pair is BTC/USDT, then setting this to Fixed Amount would order a buy or sell of 50 Bitcoins. If this setting is % of account then this would buy or sell 50% of the value of the holding.

Buy and Sell Block Inputs:

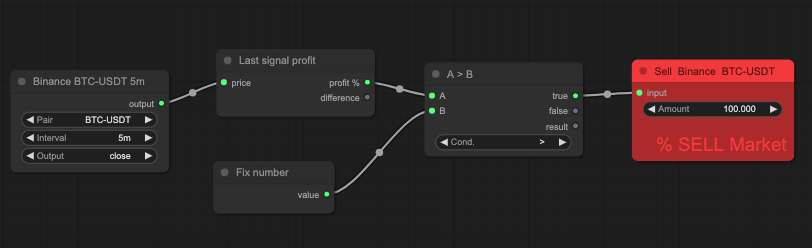

1. Main Input:

These are the conditions under which the action will buy. For example below, there is a condition block feeding the sell block with a value if the profit % after each 5 minute block exceeds the fixed number value.

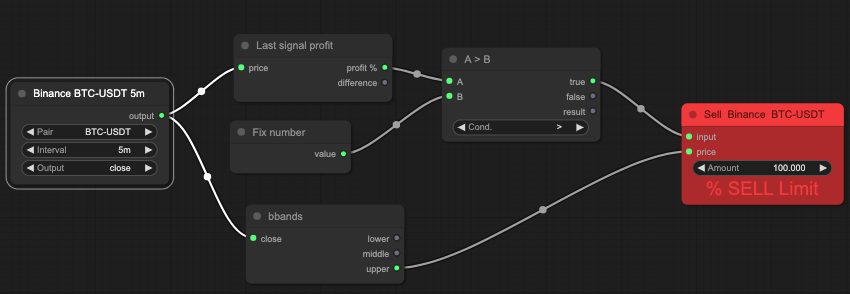

2. Limit Input:

If you change the Action block to trigger a Limit order, rather than a market order, a second input will appear where you can input the limit price. Carrying on from the example above, if I wanted to specify that after the 5 minute candle closes the strategy should open a limit order with the upper Bollinger Band value as the limit price then I could input as follows:

Feel free to enhance the adaptability of your strategy by incorporating multiple Action Blocks, each tailored with different inputs, enabling triggers under various conditions within the same strategy.