In the world of algorithmic trading, the tools you use can make all the difference between success and missed opportunities. Arrow Algo’s platform is built around a powerful, no-code block builder that allows traders to create, test, and refine their strategies with ease. At the heart of this system are four key block types: Data Watcher Blocks, Indicator Blocks, Math Blocks, and Action Blocks. In this post, we’ll dive into each of these blocks, exploring how they work and how you can use them to create customized trading strategies.

Prefer watching over reading? Watch the Tutorial Videos Instead!

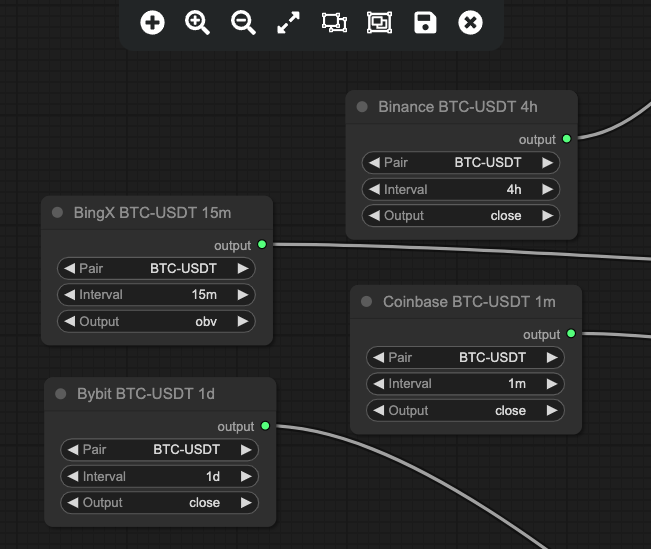

1. Data Watcher Blocks

Overview:

Data Watcher Blocks are the foundational elements of your trading strategy. These blocks continuously monitor the market data you specify, feeding real-time information into your strategy to drive decision-making.

Key Features:

- Watch Multiple Exchanges: Choose the trading exchange you want to monitor.

- Trading Pair Selection: Choose the specific assets or currency pairs you want to monitor.

- Timeframe Flexibility: Set the timeframe that best suits your trading style, whether it’s a 1-minute interval for scalping or a monthly timeframe for long-term investing or a mixture.

- Data Elements: Track specific data points like high, low, open, close prices, and more complex elements such as HL2 (average of high and low) or OBV (On-Balance Volume).

Application:

Data Watcher Blocks serve as the eyes of your trading strategy, constantly feeding relevant data into the system. For example, you can set a Data Watcher Block to monitor the closing price of Bitcoin on a 5-minute chart, which will then be used in subsequent blocks to make trading decisions.

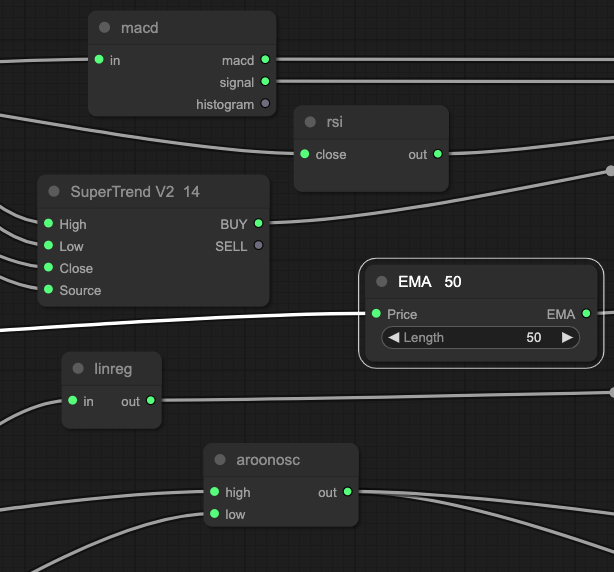

2. Indicator Blocks

Overview:

Indicator Blocks are where you apply technical indicators to the data monitored by the Data Watcher Blocks. With over 100 indicators available, these blocks help you identify trends, overbought/oversold conditions, and other key market signals.

Key Features:

- Comprehensive Indicator Library: Access popular indicators like Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, among others.

- Customization: Adjust parameters such as the period length or sensitivity to tailor the indicators to your specific strategy.

Application:

Indicator Blocks are crucial for generating buy and sell signals based on market conditions. For example, you might use an RSI Indicator Block to trigger a buy signal when the RSI falls below 30, indicating an oversold condition.

For a complete list of Indicators with explanations, you can visit the Block Library.

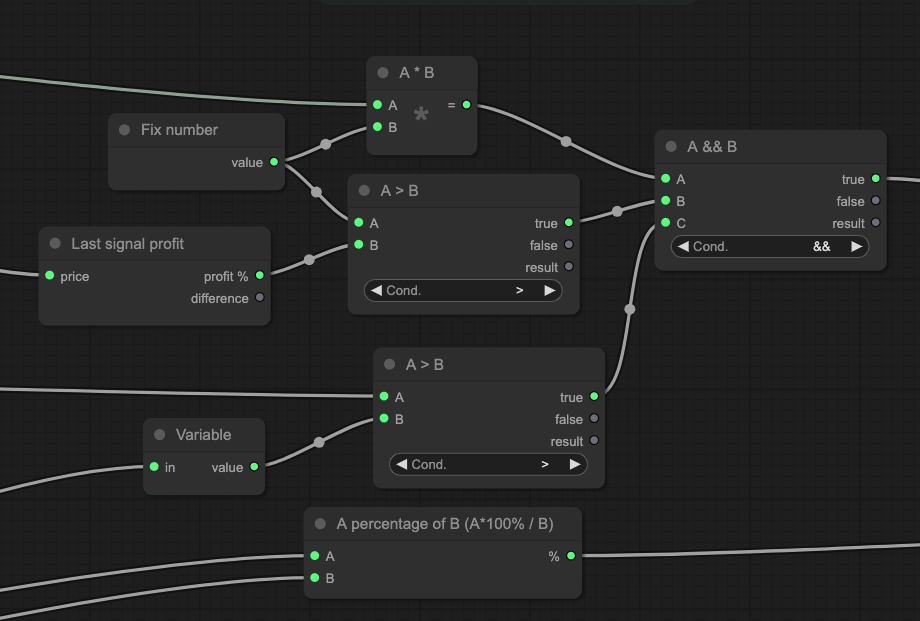

3. Math Blocks

Overview:

Math Blocks allow you to perform a variety of mathematical operations and comparisons, adding logic and complexity to your strategy. These blocks enable you to refine your trading criteria and ensure that trades are only executed under optimal conditions.

Key Features:

- Basic Operations: Use addition, subtraction, multiplication, and division to manipulate data points or insert a fixed or variable number element.

- Advanced Functions: Implement more complex operations like percentage calculations, comparisons (greater than, less than), and logical conditions (AND, OR) to fine-tune your strategy.

Application:

Math Blocks can be used to combine multiple indicators or data points to create more sophisticated trading conditions. For instance, you could create a condition where a buy order is triggered only if the closing price is above the 50-day moving average AND the RSI is below 70.

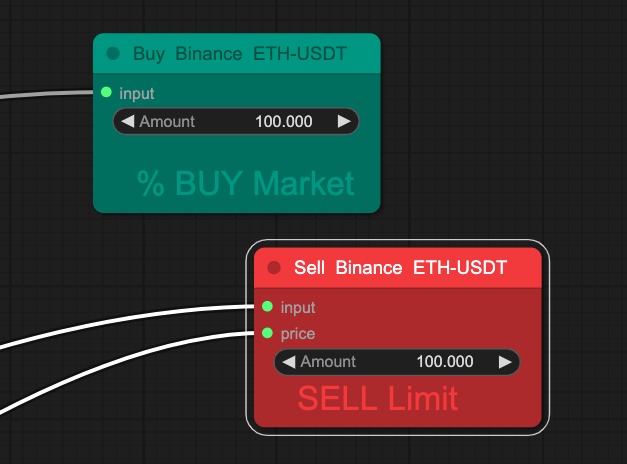

4. Action Blocks

Overview:

Action Blocks are the final step in your trading strategy, responsible for sending trade signals to your connected exchange. These blocks take the input from your strategy’s conditions and rules, then communicate the specified actions—such as placing a buy or sell order—to the exchange. The actual execution of the trade is handled by the exchange, based on the signal sent from Arrow Algo.

Key Features:

- Buy/Sell Signals: These blocks send signals to buy or sell assets when your strategy’s conditions are met.

- Order Types: Choose from various order types, including market orders, limit orders, and stop orders, to define how the trade signal is sent to the exchange.

- Trade Parameters: Specify the amount to trade, the trading venue (exchange), and other key details to ensure the trade signal aligns with your strategy.

Application:

When the conditions in your strategy are satisfied, the Action Blocks send the appropriate buy or sell signal to your connected exchange. The exchange then receives and processes the signal according to the parameters you’ve defined. For example, if your strategy triggers a buy signal, the Action Block will communicate this to the exchange, which then executes the trade based on the signal.

Build Strategies with Confidence

The combination of Data Watcher, Indicator, Math, and Action Blocks gives you the flexibility to design highly customized and effective trading strategies. Whether you’re developing a simple strategy based on a single indicator or a complex multi-condition algorithm, understanding how to utilise these blocks is key to your success on Arrow Algo.

Did you enjoy this? You may like:

Leave a Reply