In the fast-paced world of cryptocurrency trading, automated trading platforms, commonly known as trading bots, have emerged as indispensable tools for traders seeking to capitalize on market opportunities while minimizing manual intervention. These bots offer the promise of executing trades swiftly, leveraging predefined strategies to navigate the volatile crypto landscape with precision. However, behind the allure of automated trading lies a fundamental challenge: the opaqueness of these bots’ underlying strategies.

Indeed, trading bots often operate as black boxes, concealing the intricate algorithms and decision-making processes driving their trades from the user’s view. Traders are essentially required to place blind trust in these bots, entrusting their capital to algorithms they may not fully comprehend. This lack of transparency raises legitimate concerns about accountability, reliability, and the potential for unforeseen risks.

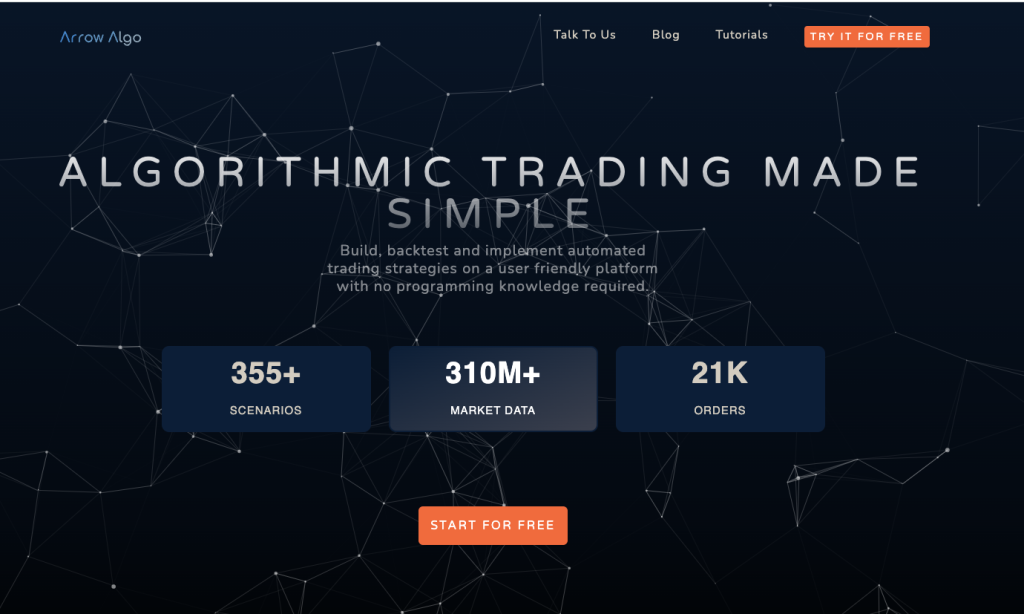

Enter Arrow Algo, a revolutionary trading software that seeks to demystify automated trading by placing transparency and user empowerment at the forefront. Unlike traditional black-box bots, Arrow Algo empowers traders with visibility into the underlying strategies driving their trades. By offering pre-built strategies that users can examine, backtest, and customize to suit their preferences, Arrow Algo transforms the trading experience from one of blind faith to informed decision-making.

In a landscape where trust is paramount, Arrow Algo sets itself apart by offering transparency, accountability, and user-centricity. By empowering traders with visibility and control over their trading strategies, Arrow Algo heralds a new era of informed and empowered trading in the cryptocurrency market. With Arrow Algo, traders no longer need to rely on blind faith—they can trade with confidence, backed by data-driven insights and strategic clarity.

Arrow Algo vs 3Commas

Arrow Algo and 3commas operate using an API key, enabling the platform to execute trades on behalf of users across various leading cryptocurrency exchanges. These platforms share several key features, including:

- Utilizing a cloud-based infrastructure for seamless 24/7 connectivity.

- Supporting integration with multiple cryptocurrency exchanges via API keys.

- Providing automated trading functionalities.

- Facilitating both long and short trading with limit orders.

- Offering a user-friendly interface for intuitive trading experiences.

- Hosting a marketplace for users to explore and acquire third-party bots or strategies tailored to their trading preferences.

Arrow Algo: An Overview

The classification of Arrow Algo as a trading bot depends on the criteria used for defining such tools. Nonetheless, Arrow Algo stands out as a robust trading platform offering advanced tools, signaling features, and comprehensive backtesting capabilities utilized by seasoned traders.

Clients of Arrow Algo gain access to a cloud-based platform capable of managing multiple cryptocurrency positions across four major exchanges officially supported by the platform. These exchanges include:

- KuCoin

- Binance

- Coinbase Pro

- Bybit

With support for 28 tokens, as indicated on its website, Arrow Algo ensures that clients have ample options for trading various token pairs without encountering any difficulty.

How Arrow Algo Operates

Upon configuration by the user, Arrow Algo empowers clients to leverage a diverse set of automated trading tools across the supported exchanges. The software seamlessly executes trades on behalf of clients, leveraging their accounts to navigate the cryptocurrency markets efficiently.

Additionally, Arrow Algo incorporates trading signals to assist users in making informed decisions regarding entry and exit points for positions. Beyond automated trading, the platform fosters a vibrant social community on Discord, where traders collaborate to capitalize on market opportunities and enhance profitability.

Arrow Algo: Tools and Features

Arrow Algo provides users with a comprehensive suite of tools and features designed to enhance their cryptocurrency trading experience. With Arrow Algo, users enjoy:

- Flexible Trading Parameters: Users can define buying and selling parameters across supported cryptocurrency exchanges, tailoring triggers to operate effectively under various market conditions. This flexibility empowers users to deploy adaptable trading strategies aligned with their preferences and objectives.

- Extensive Indicator Library: Arrow Algo offers an extensive array of over 100 indicators that users can seamlessly integrate into their trading strategies. These indicators provide valuable insights and analysis, enabling informed decision-making in the dynamic cryptocurrency market.

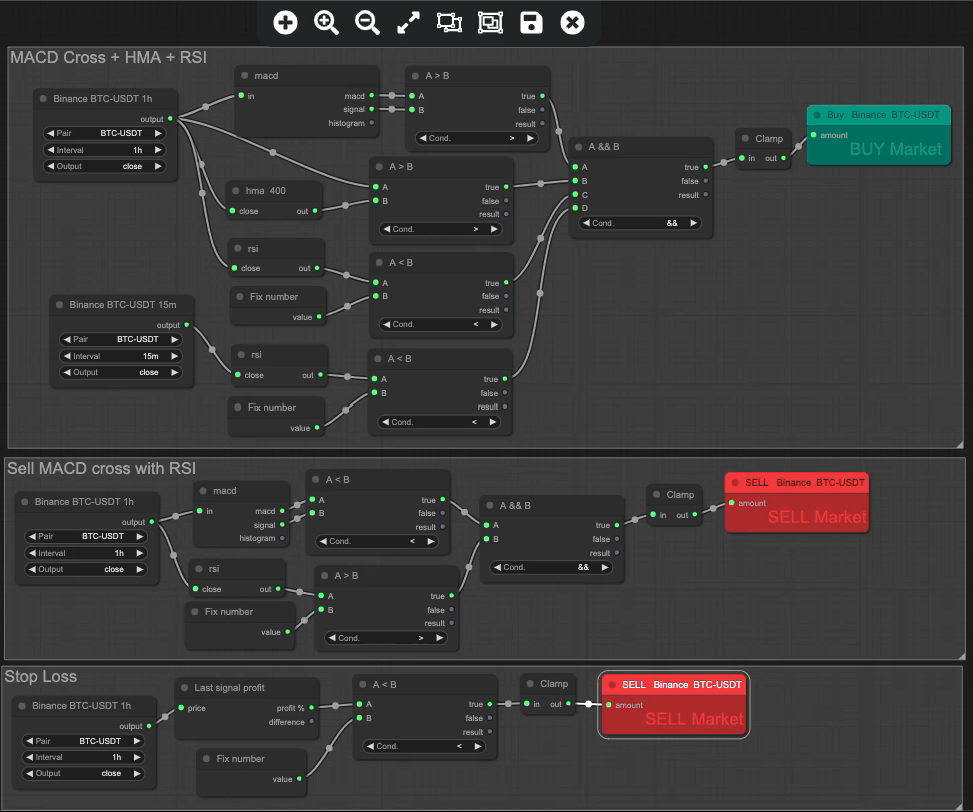

- Intuitive Strategy Builder: Leveraging a block builder-based strategy builder, users can effortlessly create both simple and complex trading strategies. This user-friendly interface streamlines the strategy development process, allowing users to customize their approaches with ease.

- Multi-Coin, Multi-Market, and Multi-Timeframe Integration: Arrow Algo facilitates the incorporation of multiple coins and markets into a single strategy, enabling users to explore arbitrage opportunities across different trading pairs and markets. Additionally, users can mix different timeframes within the same strategy, providing a holistic view of market trends and parameters.

Key Tools:

- Block Builder Strategy Builder: Empowers users to create customized trading strategies tailored to their preferences.

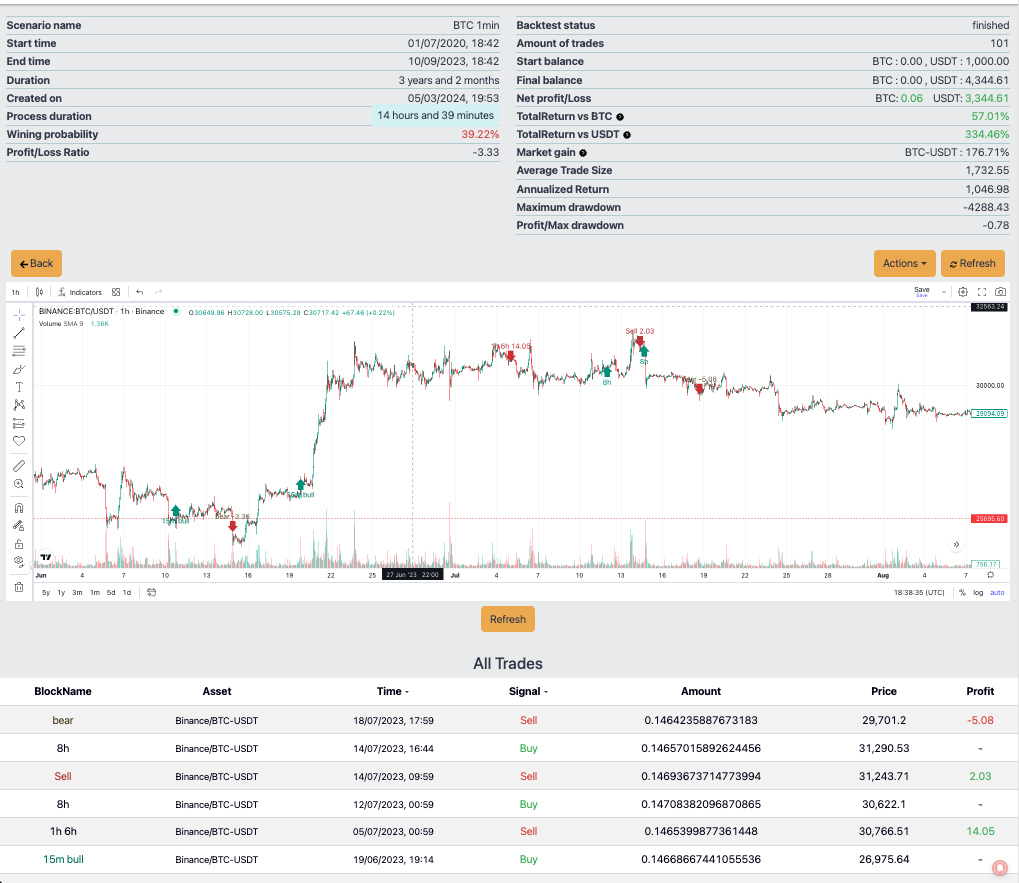

- Fast Backtest Engine: Offers a simple and extremely fast backtest engine, allowing users to validate and optimize their strategies efficiently.

- Marketplace for Strategies: Provides a marketplace for users to buy and sell trading strategies, fostering a community-driven ecosystem of trading expertise.

- Personalized Support and Learning: Offers personalized 1:1 support and learning features, including access to company-generated and user-generated learning content. Additionally, users benefit from a supportive community of traders, providing assistance and insights along their trading journey.

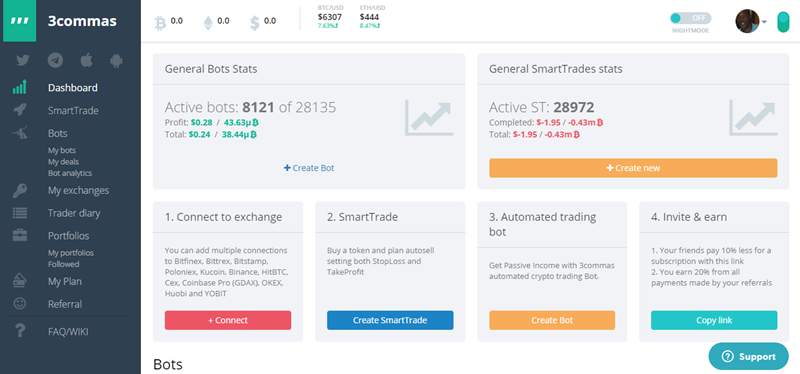

3Commas: An Overview

3Commas provides clients with a variety of automated trading options. In contrast to Arrow Algo, 3Commas offers fully automated trading bots that operate without requiring configuration from the client. However, it’s important to note that these bots operate as black boxes, meaning clients are unable to access the underlying strategy. They must trust the system blindly.

Additionally, 3Commas enables the use of simple trading tools for creating custom bots, as well as offering straightforward automated trading tools suitable for simpler trading strategies.

3Commas: Tools and Features

3Commas offers a flexible structure that caters to traders’ preferences, allowing them to utilize mostly automatic trading bots, create automated trading sequences, or simply employ automated buying and selling tools.

This versatility makes 3Commas an appealing option for traders seeking automated solutions. Its algorithms operate as black boxes, meaning users must trust the system without full transparency into the underlying logic.

Key tools offered by 3Commas include:

- Smart Trading: This feature enables users to configure trade parameters that are automatically executed by 3Commas’ cloud-based platform. Similar to Arrow Algo, Smart Trading tools facilitate market monitoring without the need for constant manual oversight.

- Auto Trading Bot: The Auto Trading Bot offered by 3Commas is fully automatic. Users can select a token pair and input basic trading parameters. Once activated, the bot executes trades on behalf of the user, potentially generating profits. However, it’s important to note that the underlying logic of these bots remains opaque, making it essential for users to exercise caution.

The Composite Bot tool allows users to mix long and short positions across various token pairs, enabling the implementation of more complex trading strategies. 3Commas provides a list of the top-performing bots from the last 24 hours, allowing users to identify trends and potentially capitalize on profitable opportunities. While these tools offer the potential for profit, users should start with caution, as any losses incurred are the responsibility of the user. Starting with small investments is advisable until users are familiar with the platform and its features.

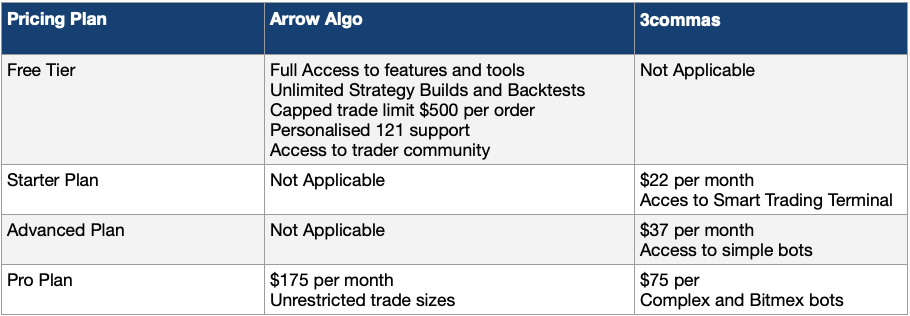

Pricing: Head to Head

Both Arrow Algo and 3commas offer distinct pricing plans tailored to different trader preferences and needs. Arrow Algo’s free tier provides users with full access to its suite of features and tools, allowing for strategy building and unlimited backtesting, albeit with a trade size limitation of $500 per buy trade. In contrast, 3commas offers three pricing tiers, starting from $22 USD per month for its Starter Package, which includes access to the Smart Trading terminal. While both platforms provide unique benefits, such as Arrow Algo’s priority customer support and 3commas’ additional features like simple bots and personal signals by Trading View, traders can choose the platform that aligns best with their trading goals and budget.

Is Arrow Algo a Better Platform?

If you’re in search of a comprehensive platform to manage your crypto trading endeavors, Arrow Algo presents itself as a compelling option. Offering an array of automated trading tools, once configured, they operate seamlessly and autonomously. Despite the perceived complexity of building one’s own trading algorithms, Arrow Algo’s platform stands out for its intuitive interface and personalised customer support and trading community.

Arrow Algo distinguishes itself in some key areas.

- Transparency and Control: Arrow Algo offers users the ability to see and modify the underlying strategies of their trading bots, providing a level of transparency and control that is not available with 3commas’ black-box approach.

- Free Tier Features: Arrow Algo’s free tier allows users to access all features and capabilities, including building and backtesting strategies, albeit with a trade size limitation of $500 per buy. In contrast, 3commas’ free trial is limited to three days and does not include access to all features.

- Extensive Range of Indicators: Arrow Algo boasts over 100 indicators that users can seamlessly integrate into their trading strategies, providing a diverse toolkit for informed decision-making. This extensive range of indicators gives users more flexibility and customization options compared to 3commas.

- Community Support and Learning Resources: Arrow Algo provides personalized support, learning courses, and a community of traders for support, enhancing the user experience and facilitating skill development. This comprehensive support ecosystem sets Arrow Algo apart as a user-friendly and accessible platform for traders of all levels.

Firstly, its robust backtesting capabilities allow users to analyze market data spanning up to a decade with remarkable ease and efficiency. The platform’s backtest engine is not only swift but also adept at handling intricate trading strategies. Additionally, Arrow Algo facilitates the integration of multiple timeframes within a single strategy, providing users with a comprehensive perspective on various trends and market dynamics.

In essence, Arrow Algo serves as a highly proficient automated trading platform, catering to individuals seeking continuous engagement with the crypto markets. With its intuitive interface, extensive support resources, and advanced features, Arrow Algo is well-suited to meet the diverse needs of crypto traders.

Leave a Reply