The meteoric rise of artificial intelligence (AI) has ignited a frenzy of investment, reminiscent of the dot-com boom. But is history repeating itself? Or is this time different?

Similarities Between the AI and Dot-Com Bubbles

Unprecedented Hype: Both periods were characterized by excessive optimism and media hype, creating a sense of euphoria around a new technology. Just as the internet was hailed as a revolutionary force in the late 1990s, AI is now seen as the next big thing, promising to transform industries and society at large.

Valuation Concerns: In both cases, valuations of companies in the sector soared to dizzying heights, often without commensurate revenue or profit. Startups and established firms alike have seen their market caps skyrocket on the promise of AI, despite some having yet to prove their business models.

Speculative Investment: Investors were driven by fear of missing out (FOMO), leading to irrational exuberance and speculative investments. The rush to invest in anything labeled “AI” mirrors the rush to invest in anything “dot-com” two decades ago.

Key Differences

Technological Maturity: While the internet was still in its infancy during the dot-com era, AI has already demonstrated tangible applications in various industries. From healthcare to finance, AI-driven solutions are already creating real value and efficiencies, suggesting a more mature technology compared to the early internet.

Government Support: AI has received significant support from governments worldwide, with substantial investments in research and development. This backing provides a strong foundation for sustained growth and innovation, something that the early internet boom lacked to a similar extent.

Global Economic Context: The current economic climate, with factors like inflation and geopolitical tensions, differs from the late 1990s. These factors add layers of complexity to the investment landscape today, impacting how and where money is being invested in AI.

Why Investor Worries Intensified This Week

The recent market performance has heightened concerns about the AI bubble. For instance, Apple and Nvidia were both down double digits on Monday, reflecting broader market volatility and investor apprehension. Such declines underscore the need for caution and strategic planning when investing in high-growth sectors like AI. Several factors may have contributed to heightened investor concerns this week:

Market Volatility: The broader market has experienced increased volatility, which can exacerbate fears of a bubble bursting. This volatility impacts investor confidence and can lead to sudden shifts in investment strategies.

Profit Warnings: Some AI companies may have issued profit warnings or missed earnings expectations, raising doubts about the sector’s growth trajectory. These warnings serve as red flags, suggesting that not all AI investments are as solid as they might appear.

Regulatory Uncertainty: Growing regulatory scrutiny of AI could create uncertainty and dampen investor enthusiasm. As governments and regulatory bodies worldwide consider how to manage AI’s risks and ethical concerns, this uncertainty can impact market sentiment.

Economic Indicators: Economic indicators, such as interest rate hikes or slowing GDP growth, can negatively impact high-growth sectors like AI. These indicators suggest a broader economic slowdown, which could hinder investment and growth in AI.

Trading Without Emotions

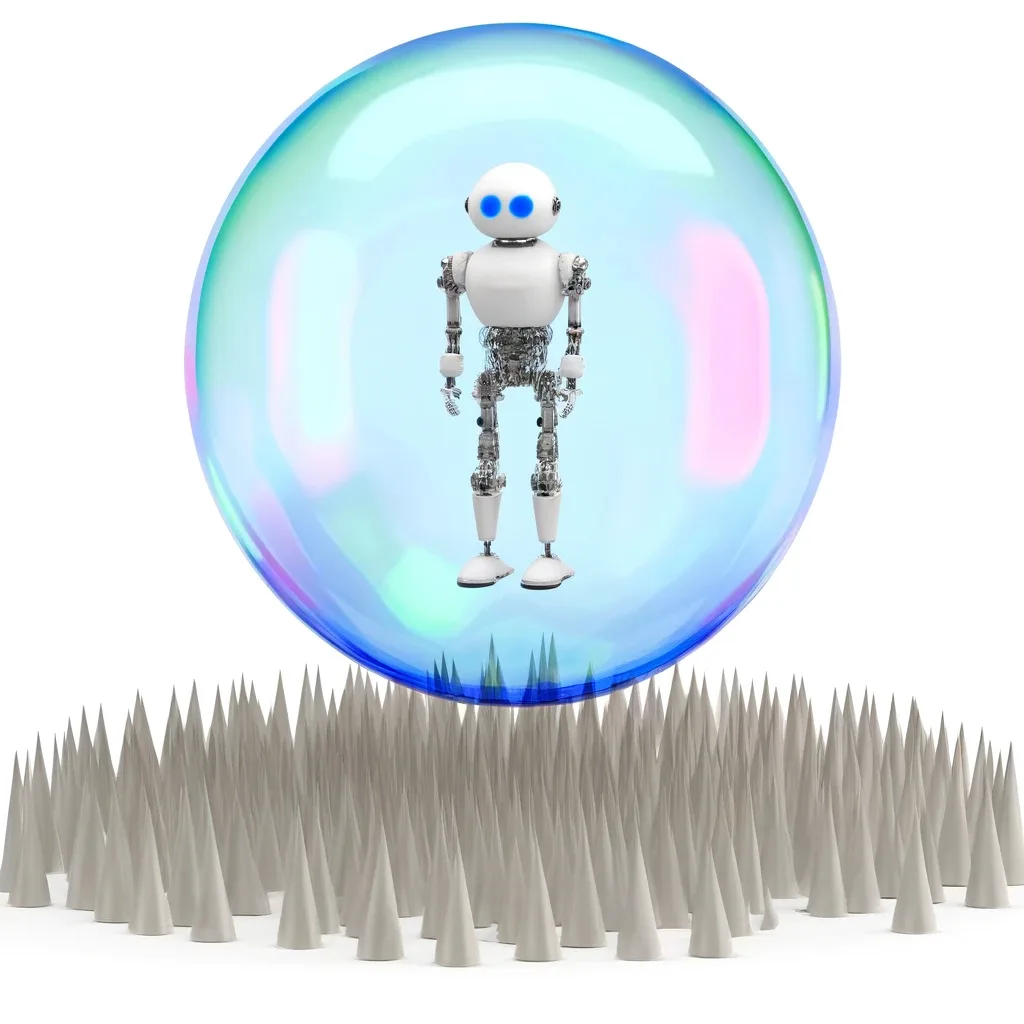

In the midst of this speculative frenzy and market volatility, trading without emotions becomes crucial. Emotional trading often leads to impulsive decisions driven by fear and greed, which can result in significant losses. Utilizing algorithmic trading platforms like Arrow Algo can help mitigate these risks. Arrow Algo allows traders to build and backtest strategies in a no-code environment, ensuring that decisions are based on data and predefined rules rather than emotional reactions. By leveraging such free platforms, traders can maintain consistency, optimize their strategies, and improve their overall performance without the pitfalls of emotional trading.

Navigating the AI Investment Landscape

While the parallels between the AI and dot-com bubbles are undeniable, the current landscape is more complex. The potential of AI is immense, and many companies are already generating significant value. However, it is crucial for investors to approach the sector with caution and conduct thorough due diligence.

A bubble burst is a possibility, but it is equally plausible that the AI industry will continue to thrive and transform the world. The key lies in distinguishing between companies with solid fundamentals and those driven solely by hype. By trading with a clear, data-driven strategy and leveraging tools like Arrow Algo, investors can navigate this dynamic landscape more effectively.

Did you like this? You may enjoy:

Leave a Reply