Algorithmic trading has transformed the financial markets, allowing traders to execute orders with speed and precision based on pre-set criteria. As the demand for efficient trading solutions grows, choosing the right algorithmic trading software becomes crucial. Here’s a guide to understanding what makes a great algorithmic trading platform and why Arrow Algo is an excellent choice for traders at all levels.

Key Features of a Good Algorithmic Trading Platform

1. Customizability and Flexibility: A top-notch algorithmic trading platform should offer high customizability, allowing traders to design and tweak their trading strategies. Flexibility in terms of strategy development is vital, as it enables users to adapt to changing market conditions.

2. Backtesting Capabilities: Effective backtesting features are essential. They allow traders to test their strategies against historical data to gauge potential performance. A platform that provides detailed backtest reports helps in refining and optimizing strategies before deploying them live.

3. Real-Time Data and Execution: Access to real-time market data and the ability to execute trades promptly are critical for algorithmic trading. Delays in data or execution can significantly impact the effectiveness of a trading strategy.

4. User-Friendly Interface: Even the most powerful tools need to be user-friendly. A platform with an intuitive interface ensures that traders, regardless of their technical expertise, can navigate and utilize the features effectively.

5. Reliability and Security: Reliability in terms of uptime and performance is non-negotiable. Additionally, robust security measures are crucial to protect sensitive financial data and personal information.

The Importance of Choosing the Right Algorithmic Trading Platform and Why Arrow Algo Stands Out

Algorithmic trading has transformed the financial markets, allowing traders to execute orders with speed and precision based on pre-set criteria. As the demand for efficient trading solutions grows, choosing the right algorithmic trading software becomes crucial. Here’s a guide to understanding what makes a great algorithmic trading platform and why Arrow Algo is an excellent choice for traders at all levels.

Key Features of a Good Algorithmic Trading Platform

1. Customizability and Flexibility: A top-notch algorithmic trading platform should offer high customizability, allowing traders to design and tweak their trading strategies. Flexibility in terms of strategy development is vital, as it enables users to adapt to changing market conditions.

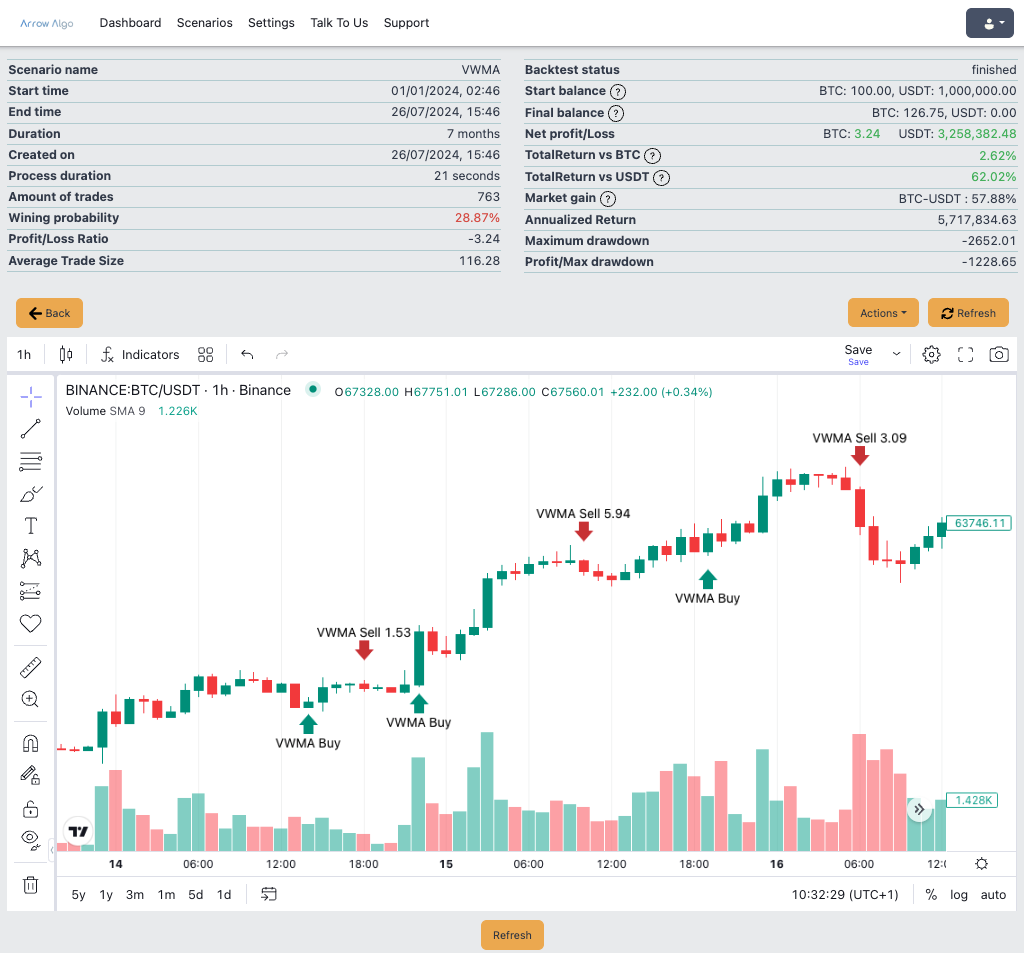

2. Backtesting Capabilities: Effective backtesting features are essential. They allow traders to test their strategies against historical data to gauge potential performance. A platform that provides detailed backtest reports helps in refining and optimizing strategies before deploying them live.

3. Real-Time Data and Execution: Access to real-time market data and the ability to execute trades promptly are critical for algorithmic trading. Delays in data or execution can significantly impact the effectiveness of a trading strategy.

4. User-Friendly Interface: Even the most powerful tools need to be user-friendly. A platform with an intuitive interface ensures that traders, regardless of their technical expertise, can navigate and utilize the features effectively.

5. Reliability and Security: Reliability in terms of uptime and performance is non-negotiable. Additionally, robust security measures are crucial to protect sensitive financial data and personal information.

Why Choose Arrow Algo?

Arrow Algo excels in all the key areas of a high-quality algorithmic trading platform. Here’s why it stands out:

1. No-Code Customization: Arrow Algo provides a no-code platform, making it accessible to traders without programming skills. The block builder interface allows for easy customization and development of trading strategies with over 100+ trading indicators to include such as moving averages, trend, volume, volatility or momentum indicators. The platform caters to both beginners and experienced traders.

2. Advanced Backtesting: Our platform offers comprehensive backtesting tools that simulate trading strategies against years of historical data. This feature helps in identifying the strengths and weaknesses of a strategy, enabling traders to optimize their approaches before going live.

3. Real-Time Market Data: Arrow Algo ensures access to real-time market data and instantaneous trade execution, critical for capitalizing on market opportunities without delay.

4. User-Friendly Design: The intuitive interface of Arrow Algo ensures that traders can easily build, test, and deploy their strategies. Our platform’s design focuses on user experience, making it straightforward for users to achieve their trading goals.

5. Reliability and Security: With Arrow Algo, traders can rely on a robust and secure platform. We prioritize uptime and data security, ensuring that our users can trade with confidence and peace of mind.

6. Community and Support: Arrow Algo fosters a strong community of traders who share insights and strategies. Additionally, our support team is always available to assist users with any issues or questions, ensuring a smooth trading experience.

Conclusion

Choosing the right algorithmic trading platform can significantly impact your trading success. With its no-code customization, advanced backtesting capabilities, real-time data, user-friendly design, and robust security, Arrow Algo is an excellent choice for traders looking to maximize their potential in the markets standing out from competitors like 3Commas and MetaTrader.

Start your journey with Arrow Algo today and join a community of traders dedicated to success. For more information, visit our website.

Did you enjoy this? You may like:

Leave a Reply