Fibonacci retracements are a popular technical analysis tool used by traders to identify potential support and resistance levels. Rooted in the Fibonacci sequence, a mathematical series found in nature, the tool helps traders anticipate how far the price might retrace before resuming its trend.

What is Fibonacci Retracement?

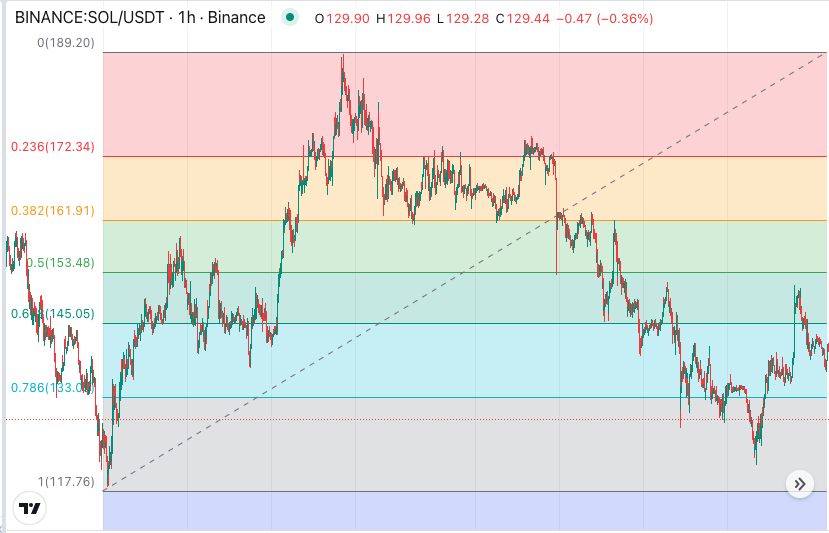

Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. These levels are derived from the Fibonacci sequence (1, 1, 2, 3, 5, 8, 13, and so on) and are expressed as percentages: 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders use these percentages to measure how much of a previous move the price is likely to retrace.

- 23.6% retracement is a shallow pullback.

- 38.2% and 50% retracements are considered moderate pullbacks.

- 61.8% retracement is seen as a strong pullback, often referred to as the “golden ratio.”

- 100% retracement means the price has completely reversed.

How Fibonacci Retracement is Calculated

To calculate Fibonacci retracement levels, traders look for two key price points—one high and one low—and divide the vertical distance by the key Fibonacci ratios. For example, if a stock moves from $100 to $200, the levels would be:

- 23.6% retracement: $176.40

- 38.2% retracement: $161.80

- 50% retracement: $150.00

- 61.8% retracement: $138.20

These levels serve as potential areas where the price could reverse or continue its trend.

How Traders Use Fibonacci Retracements

Identifying Reversal Points: Traders use retracement levels to predict where a stock might pull back before continuing its trend. If a stock is rising, they will look at these levels as potential support points. If the stock is falling, the levels could act as resistance.

Setting Entry and Exit Points: Fibonacci retracement levels are also used for setting entry and exit points for trades. For instance, a trader might buy at a 61.8% retracement level in anticipation of a trend continuation.

Combining with Other Indicators: To increase the accuracy of trades, Fibonacci retracement levels are often used alongside other technical indicators like moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). This combination helps traders confirm whether the retracement level will hold or break.

Practical Example

Imagine you’re analyzing Bitcoin, which rises from $25,000 to $35,000. After the price surge, it starts to pull back. You apply Fibonacci retracement levels to the chart and find that the price is hovering near the 61.8% level at around $29,000. Many traders would see this as a potential buy zone, anticipating that the price may bounce back from this key level.

Advantages and Limitations of Fibonacci Retracements

Advantages:

- Easy to Use: Applying Fibonacci retracement levels is straightforward and doesn’t require complex calculations.

- Universal Application: Works on all timeframes and with all types of assets.

- Provides Clear Levels: Helps identify clear levels for potential market reversals.

Limitations:

- Not a Standalone Tool: It’s not always accurate by itself and should be combined with other technical indicators.

- Works Best in Trending Markets: It is less reliable in choppy, sideways markets where price action is less predictable.

Fibonacci Retracements on Arrow Algo

At Arrow Algo, we offer an intuitive block builder that allows users to easily integrate Fibonacci retracement levels into their trading strategies without coding. By combining Fibonacci retracements with other indicators in our platform, you can develop well-rounded trading strategies, backtest them on historical data, and improve your market performance.

Fibonacci retracements are an excellent tool for traders looking to refine their strategies. Whether you’re a novice or an experienced trader, understanding how to apply these levels can provide key insights into market behavior and enhance your decision-making process.

Did you enjoy this? You may like:

Leave a Reply