In the realm of trading, moving averages are essential tools that help traders smooth out price data and identify trends. Among the various types of moving averages, the Volume Weighted Moving Average (VWMA) stands out due to its unique incorporation of volume into the calculation. This blog post will explore how the VWMA is calculated, its applications in algorithmic trading, and how Arrow Algo integrates this powerful tool into its platform.

What is the Volume Weighted Moving Average (VWMA)?

The Volume Weighted Moving Average (VWMA) is a type of moving average that takes into account the volume of trades for each price point. Unlike simple moving averages (SMA) that give equal weight to all data points, VWMA assigns more weight to periods with higher trading volumes. This makes it particularly useful for identifying periods of high activity and significant price movements.

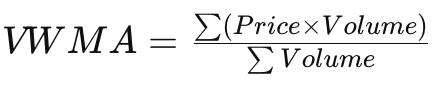

How is VWMA Calculated?

The calculation of the VWMA involves multiplying the closing price of each period by the corresponding volume, summing these products over the desired period, and then dividing by the total volume for the same period. Here’s the step-by-step process:

- Multiply the closing price by the volume for each period.

- Sum these values over the chosen number of periods.

- Sum the volume for the same number of periods.

- Divide the sum of the price-volume products by the sum of the volumes.

The formula for VWMA can be expressed as:

Application of VWMA in Algorithmic Trading

The VWMA is an excellent tool for algorithmic trading due to its ability to reflect the influence of trading volume on price movements. Here are some ways it can be utilized:

- Trend Identification: VWMA helps in identifying trends more accurately by factoring in the volume. Periods of high volume often indicate strong market sentiment, making VWMA a reliable indicator for trend confirmation.

- Support and Resistance Levels: VWMA can highlight support and resistance levels by showing the price points where high volumes have been traded. These levels can be crucial for setting stop-loss orders and identifying entry/exit points.

- Trading Signals: When used in conjunction with other indicators, VWMA can generate robust trading signals. For example, a crossover strategy involving VWMA and another moving average can help traders identify potential buy or sell opportunities.

- Volume Analysis: By incorporating volume, VWMA provides deeper insights into market dynamics, helping traders understand whether a price move is supported by substantial trading activity or if it’s likely to be a short-term fluctuation.

Practical Application in Arrow Algo

At Arrow Algo, we understand the importance of integrating advanced indicators like VWMA into your trading strategies. Our platform offers seamless incorporation of VWMA, allowing you to easily include this indicator in your algorithmic trading models.

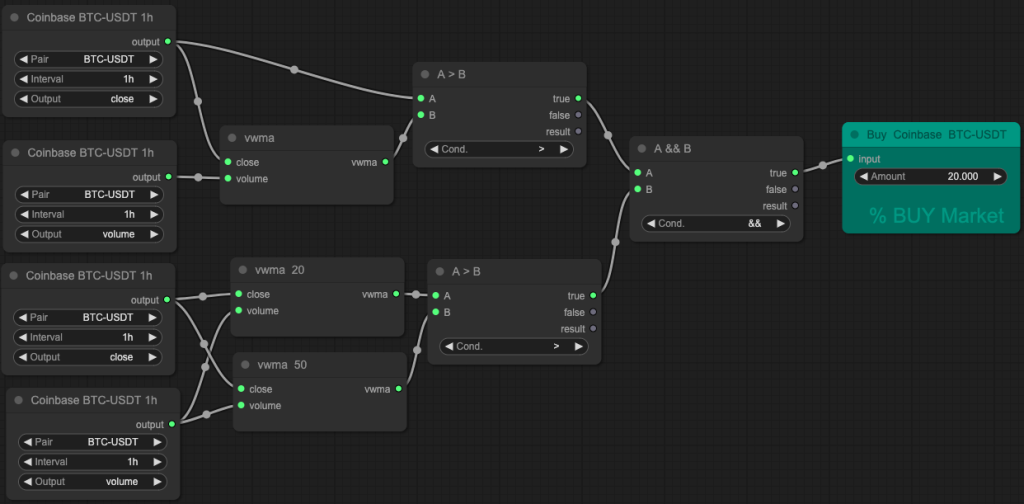

Here’s how you can practically use VWMA on Arrow Algo:

Access VWMA: Navigate to the indicators section on the Arrow Algo platform and select VWMA from the list of available indicators.

Customize Parameters: Set your desired period for the VWMA calculation to match your trading strategy. You can adjust the period based on the timeframe you are analyzing.

Incorporate in Strategies: Use VWMA in combination with other indicators to create robust trading strategies. For instance, you can set up a strategy with specific rules:

- Check if the current 1-hour price is higher or lower than the VWMA.

- Check if the VWMA20 (20-period VWMA) is higher or lower than the VWMA50 (50-period VWMA).

These conditions can be used to trigger buy or sell signals. For example:

- Buy Signal: If the 1-hour price is above the VWMA and the VWMA20 is above the VWMA50.

- Sell Signal: If the 1-hour price is below the VWMA and the VWMA20 is below the VWMA50.

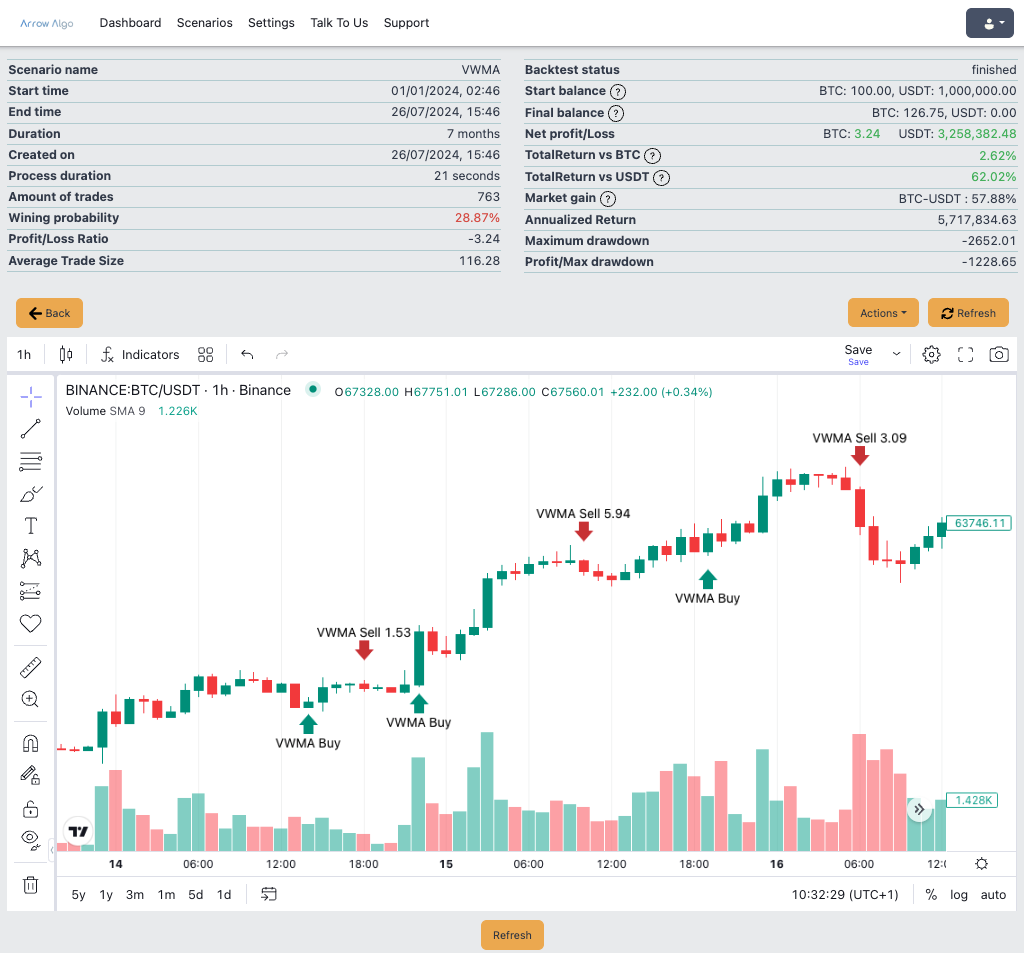

Backtesting: Test your strategies using historical data to ensure their effectiveness before deploying them in live trading. This step helps in understanding how your strategy would have performed in past market conditions.

By integrating VWMA into your trading strategies on Arrow Algo, you can take advantage of volume-weighted insights to make more informed trading decisions. Our platform’s user-friendly interface and advanced tools make it easy to build, test, and optimize your strategies with VWMA.

Take Your Trading to the Next Level with VWMA

The Volume Weighted Moving Average (VWMA) is a powerful tool for traders looking to incorporate volume into their analysis. By providing a more nuanced view of price movements, VWMA can enhance your trading strategies and improve your decision-making process. With Arrow Algo, integrating VWMA into your algorithmic trading has never been easier. Start leveraging the power of VWMA today and take your trading to the next level.

For more detailed guides and tutorials, visit our website www.arrowalgo.com.

Did you enjoy this? You may like:

Leave a Reply